NOTE: Substack’s warning me that Gmail has a email limit that is nowhere near adequate for my article, so it’ll truncate the text. I’ve decided to say “fuck it” and not play their games of suppressing attention spans for pursuit of profit - and you can just go read the entire article on desogames.substack.com after it’s cut off. Get a better email provider because the warning popped up on page 10 out of 31 in my own document, and i’m not gonna chainspam “episodes” everytime i’ve got something to say. You have been warned.

For my return to writing articles, i wanted to try and collect my thoughts on something i've said many times over the past 2 years, and something that is now coming to pass in a way for all to see.

The problem is Too Big.

What do i mean by that? I've explained many times along the way that it's because of Debt, that there's simply too much of it out there. Combined with the fact that Debt is money, it means that liquidity and solvency crises have become indistinguishable from each other and will continue to feed into eachother until the system in its entirety fails.

But, i'm getting ahead of myself. The purpose of this article is to explain how the problem has become too big, rather then why. That'll come naturally once people realize all the problems that have been stacked ontop of eachother in order to form "the" problem. Unfortunately we live in a society that has elected to paper over mistakes rather then fix them, and that simply cannot continue indefinitely.

And i think the simplest way of showing how deep the rabbit hole goes, is by naming every problem i know of concerning debt or money in some form or another. I think the overwhelming number of them will be enough to prove my point.

Housing

Lets start with a familiar one, shall we? Many countries are experiencing housing bubbles at this time. The ones we know about; Canada, Australia, New Zealand, China; but also countries people generally don't think of having housing bubbles.

Like Germany. Oh sure, you might not think it's in a bubble. Until you pull up a chart of the German House Price index, and zoom out a bit.

Leaving aside questions of hyperinflation, objectively speaking, housing prices more then doubling in a decade is a problem. People say you can't see bubbles, but that's bullshit.

The reason why people "don't see bubbles" is because they participate in them, and once your money is on the line, you're heavily biased to see something succeed. This is simple logic. Objectivity means separating yourself from those emotions (i'm way too poor to afford a house) and looking at something in an "emotional void", where only nature and reality count.

So, why is housing prices doubling in a decade a problem then? People are getting rich off houses right, what's the big deal?

Well, again, debt. When you see housing prices rise, you're not actually seeing people getting richer. You're seeing debt rise. Simply because houses are expensive. How many people do you know, or have you heard about, that have bought a house outright with cash?

So think about it. How are you going to pay down a mortgage with the house itself after it's risen in value?

You can't. There's 2 options: Selling or Refinancing. Not everybody wants to be a landlord, nor can the entire nation consist of only landlords.

In the case of selling, somebody else gives you the money for the house. So, if housing prices have doubled in 10 years, the mortgage somebody else needs to engage in to buy that house from you, also doubled in 10 years.

Refinancing is nice for personal income, but unless that income is spent on generating more income - all you're doing is buying an old house at a new price. And when you're talking a decade, during which mortgages rates fell historically low, incentivising people to refinance - how much money have the people actually gained, and how much did the mortgage holders actually gain?

The point being, during the past decade alot of that refinancing was spent on consumption rather then production, because price increases like this generate expectations: they'll go up forever, so why worry?

Well, the worry is in the "more debt" that the next person needs to take on while wages and income don't keep pace. Eventually, that starts pricing people out of the market, and sales slow down. Once prices start falling, everybody who wasn't worried about refinancing, now suddenly is very much worried. Those who planned to are probably screwed, while those who recently refinanced, are very much screwed. The same mechanic that pushed prices up, starts working in reverse, leading to a housing market crash.

It's here that we reach the first point of "the problem is too big". The above is a very normal, healthy market mechanic. Prices go up, stuff gets overbought, prices stagnate and fall. Stuff gets cheap, more people jump back in, prices recover. During economic expansion, the fall is slightly less then the rally, while during contraction, the fall is slightly more. Some people win, some people lose, but generally the market is in a sine-wave equilibrium.

But like a sinewave, the amplitude can be increased thanks to market distortions, such as artificially cheap debt. Meaning, the rally can be fueled to go on longer and further - but that necessarily means the return to the mean will be quicker and more destructive, causing a heavier undershoot and longer recovery to the mean. The so called "hard landing".

Since mortgage rates are based on government interest rates, the amplitude of the housing bubble is the same as the amplitude of the bond bubble (which we'll get to later). Or in other words, when the government bonds return to their historical averages, the mortgage rates will as well.

So we can find out the size of the problem by looking at historical mortgage rates and current mortgage rates in Germany.

This is the longest term chart i could find. I'm not even sure how to calculate back from negative rates to +7,6%. But it should be pretty clear to anybody that mean mortgage payments are multiples away from where we are now.

So we've reached a point where, should we return to the mean, many people will not be able to afford mortgages. This counts for the people currently owning a mortgage, and new people looking for houses. Meaning, not only can the people who hold mortgages no longer pay them, there is zero chance they can sell the house to get out from under it either. Refinancing has to be done at higher rates instead of lower ones, so that increases payments rather then decreasing them - doubly so if housing prices rose at the same time. Bankruptcy is the only possible option, which leads to writedowns at the mortgage holders - the banks.

If it's any wonder why the Bundesbank hasn't protested the low interest rates set by the ECB in a while, no need to wonder. If those rates go up, the German housing bubble collapses. With it, the German economy, and with that, the German banking system - and the entire EU shortly after.

There is no solution to this. Either the economy is allowed to fail so bad debts can be cleared, or it can be bailed out through stimulus and money printing like the last 2 times which worked so well.

But that's just one problem, one found in many western economies which believe they're safe - i wanted to highlight a country nobody is thinking of having a housing bubble, to show that that problem is far more widespread then generally thought.

Car loans

I'll be talking more about the US going forward, considering it is the most heavily indebted of the western nations, and a prime example of a problem gone too far. Thanks to the dollar being the global reserve currency, it's also a major - if not thé reason - global supply shortages persist. But we'll get to that point soon enough.

It's also it's because their data offerings are very neatly organized and abundant (mostly).

In 2019, 276,5 million vehicles were registered within the US. If those loans were equally distributed between all vehicles within the US, each and every single one would have $4,628.84 on debt on it.

But naturally, they're not. Rich people will buy cars outright, while it's the poor who buy cars on down-payments. So the question is, how much more debt can those people take on?

Well, for cars, there's one way to check how bad the state of the lending market is: Average car loan duration. Simply put, the longer the duration of the loan, the lower the monthly payments can be, spreading out the cost of the loan over a longer timeframe.

But it also means more financing stress for the financier as their income is reduced on a monthly basis. Easy money, meaning cheap access to credit, is a necessary component here too. So, while money remains cheap, if lenders are running out of income to buy cars with (because if you don't have savings, you buy stuff with income), lowering the payments per month will allow more people's income to be sufficient.

So we can track whether or not there's a "car loan bubble" objectively by tracking the average car loan duration.

Note that these are used car loans. They give a better image of the downtrodden's ability to take on debt since anybody with any sort of financing means will buy a new car. The average amount right now is distorted because of the effects of hyperinflation, but i wanted to include it none the less.

Mainly because to the careful observer, it shows that the current pricing problems have little to do with Covid supply issues, and everything with continuous money printing and debt increases over the past decade. Otherwise, the average amount for used car loans wouldn't start tilting up in 2016 - even while average maturity continued to rise. No shortages, No pandemics, No financing problems at the time.

But we'll get to the currency bubble later. For now, it suffices to say that - atleast in the US - there's a "car bubble". Meaning; once the ability to finance new/used cars inevitably hits a brick wall, the market will be flooded with very cheap cars nobody can afford, the same outcome as the picture in housing above. It if wasn't for cheap credit, the US car market would be dead already.

Student loans

While debt may be good to pull future production forward to the present in order to time-compress income, once the excess money has been spent, debt is a drag on income, until the new production comes online that increases one's income back to par. Then, when the debt is paid off, the additional income counts as new income, and one gets richer while value is added to society (otherwise the products don't sell and new income isn't generated).

So, putting people into debt when they start off in life, requiring them to work off that debt while their income is at the lowest possible level (entry level jobs) - is just plain ol' insane. It may seem fine, because those people got an education with which to pay down those loans even if it takes a long time, but that's a short-term fallacy that falls apart when you look at a timeframe beyond a politician's time in power.

And that's because of compounding. Meaning, gaining a percentage per month will start developing into an exponential curve. If you invest $10,000 into the market at a 1% monthly compounding rate, you're not going to end the year at $11,200, or 12x$100.

You'll have: $10,000 - $10,100 - $10,201 - $10,302.01 - $10,405.03 - $10,509.08 - $10,614.17 - $10,720.31 - $10,827.51 - $10,935.79 - $11,045.15 - $11,155.60 - $11,267.16.

There's a $67.16 difference there. To the upside.

Sure, on an amount of $10,000 it isn't that much. But what you need to understand here, is time and how exponential curves work. The front of that curve is ALWAYS going to be slow. Slow for a very long time, then very fast very quickly.

This because nominal numbers matter. If bread costs $1 per bread, then $67.16 buys you 67 breads - but $671.60 buys you 671 breads. So if you but $100,000 instead of $10,000 into the market at a 1% compounding rate, you're gonna end up with $112,671.60. This is what people mean with "having capital work for you" - With $1 million, you end up with $1.12 million. If you then live on a yearly income of $50,000 - very much doable where as $500 a year is not - you still end up richer at the end of the year. Because next year, you still have $1.07 million compounding in the market, instead of starting off with $1 million.

So if you're stuck for 10 years, being unable to invest income into compounding ventures because you're forced to pay off debt - then you're going to have to start the compounding process in your 30s. Or later these days.

That process usually means investing a little bit of money at the time into compounding assets, then reinvesting winnings as well to build up a pension. But if that little bit of monthly money goes into paying down debt - or worse, perpetually servicing the interest - it can't go into the market. Money can only be spent once. And the whole point of compounding returns isn't the early returns. It's getting to that million so that your money can start working for you while the next generation builds up its pension.

I wanted to start off with that as it's the main problem of student lending - America and indeed other western nations basically consigning their young to debt-slavery for life - and it's the main thing that should be changed, bailouts be damned. That's one mistake i'd be willing to pay for to fix.

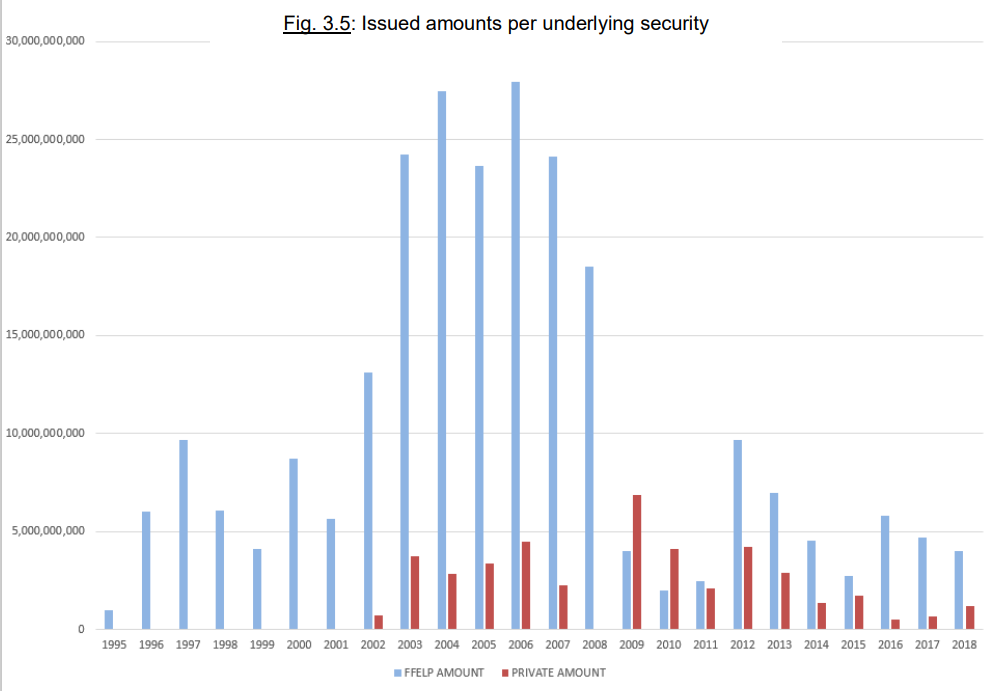

Having said that - any of that is hardly objective. Sure, it's an objective problem, but it doesn't give us any metrics of how student loans have gotten "out of hand". For that, i'll return to some of my earliest research in 2019, into SLABS: Student Loan Asset Backed Securities.

Oh yes. MBS, for student loans. You think there's something Wallstreet hasn't securitized? That was my thesis looking into the student loan problem trying to find inflection points for the coming crisis, and i came across this thesis about SLABS and the securitization of the US student loan market:

The crux of the story there being, the "government guaranteed loans" you heard so much about, the so called FFELP loans, were severely restricted after the 2008 crash due to rampant fraud with them. Regardless, the student loan market never failed, and Sallie Mae was never bailed out like Freddie Mac and Fannie Mae were.

In short, while it'd be hard to find objective evidence for it - we can surmise that an entity which isn't punished for its bad behavior, will continue to exhibit that behavior as long as it's profitable to them. And as such, since Wallstreet is continually bailed out of its problems, it's a virtual guarantee that SLABS have been treated the same as MBS were pre-2008.

At the time i did my research at the end of 2019, i read that around 50% of all loans were now private, non-government guaranteed loans. In those cases, the "guarantee" comes from a co-signer on the loan, often the student's parents, and collateralized by their assets such as a house or a car.

So - you could see a government guaranteed FFELP loan as "AAA" rated. After all, the government guarantees it, so you'll always get your money back. Safe as can be. But private loans depend on the creditworthiness of the borrower, as well as the value of the collateralizing asset (as well as the issue of multiple claimants), so they could be rated anywhere from AA to C.

And since "the good stuff" ran out after 2008, but the line shown above in total student loans outstanding is a linear expansion straight through 2008, the only logical answer to keeping the party going is "slicing up more and more trash with few and fewer AAA slices and bet nobody figures out that "guaranteed" doesn't have to mean guaranteed."

Sallie Mae remains a private corporation (with a name change to Sallie Mae Corporation, $SLM), and despite the masses of liquidity out there - i remain convinced i'll see that company bailed out and/or nationalized within a decade when this problem finally comes to a head.

Naturally, if people lose it all over student loans they can't pay - how are they going to buy a car, or a house for that matter when they're unable to save for a downpayment?

Credit Cards

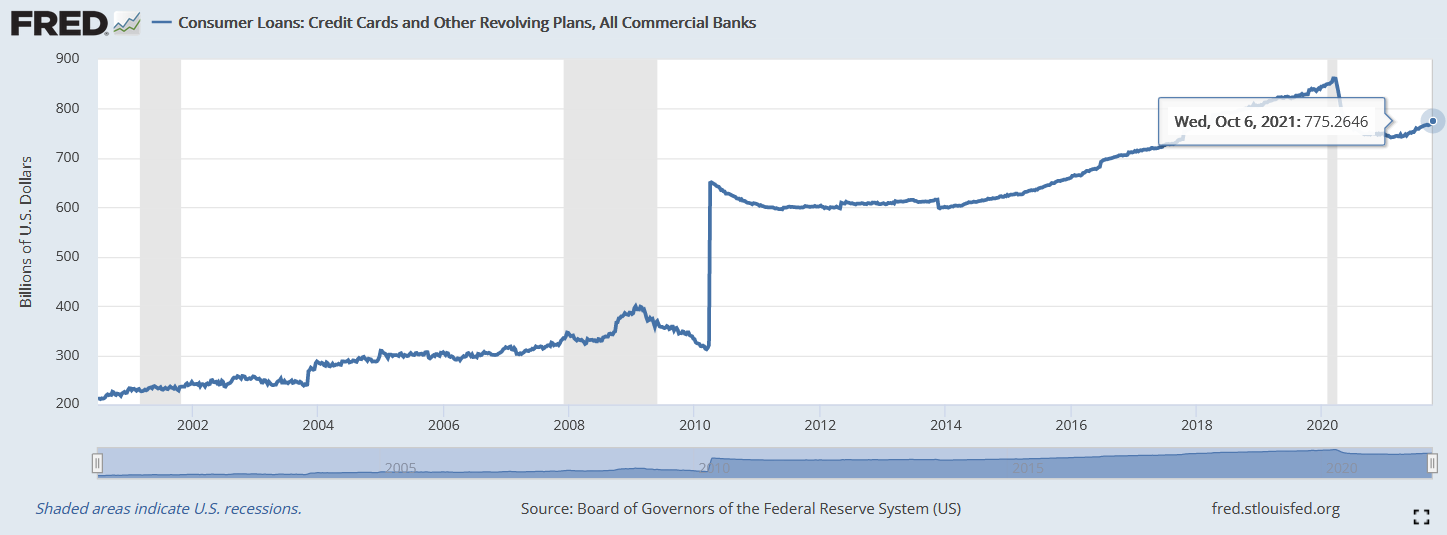

It's well known US citizens mainly live on credit, and the main source of revolving credit is credit card debt. This is something that'll differ heavily from country to country, but it's no doubt atleast in the US it's a major problem. If debt is already a drain on income, revolving debt is a much larger and continuous drain on income, as credit card debt often comes with sky-high interest rates.

While it's not a bad thing credit card and other revolving credit has taken a dip thanks to stimulus checks (which also juiced the savings rate around the same time), these two graphs should be seen in conjunction with everything else i'm presenting in this article.

Clearly, standards to get a credit card have never been so loose. Yet the rate of increase in new revolving credit is mediocre at best, and not even anywhere near its pre-pandemic high. Though, in absolute terms, credit card debt is still very high. Even if we assume the 2010 spike is an accounting change, removing $330 billion from the Oct 6 number leaves $345 billion - still equal to September 17th 2008 (2 days after Lehman). That's alot of revolving debt with a high interest rate.

If everything is fine, then why - with historic low interest rates so debt's still very cheap for them - are credit card companies pricing revolving credit like we're in a depression?

Still. Why aren't people getting more revolving debt, even when stimulus checks have run out and unemployment assistance has ended?

Well - if you reach the maximum capacity of debt, short term debt and revolving debt are the first to go. You can't take on credit card debt if you've got no income to spare servicing that debt. Paying off credit cards with credit cards ends at some point.

There looks to be overcapacity in ability to service credit cards, though the interest rate remains stubbornly high because none of the credit card companies believe the economy is functioning well - creating an historic spread between credit card rates and treasuries. That shouldn't be there if the overcapacity was there. Therefore - i don't think it is.

I've tried finding data on amount of payday loans, as those are generally the last resort before somebody goes broke, along with pawning off stuff you already own. But unfortunately nobody seems to have a chart on the amount of payday loans within the US, or their interest rate.

I did find this on Bloomberg though:

Margin debt

Debt is debt, and loans are inexorably linked with debt. Can't have debt without lending something first, even if it's money limited to investing into the stock market.

I'll skip the question of whether it's a bubble or not. Question is, who is this going to hurt on the way down?

Well, as margin is a loan all the same, made to people to invest in the stock market, the creditors are the ones who get hurt on the way down at these levels. As the old saying goes, "If you owe the bank $1000, you have a problem, but if you owe the bank $1 million, the bank has a problem."

When the market turns - and at some point, it has to - the people who are most responsible for lending this much margin - hedge funds - will blow up and liquidate. This then means that the people who lent that money to them - big banks - are the ones who'll suffer the writedown of money going poof.

This WILL lead to a banking crisis..... or atleast, it should. If banks didn't have so much excess reserves to cushion any blow from collapsing credit.

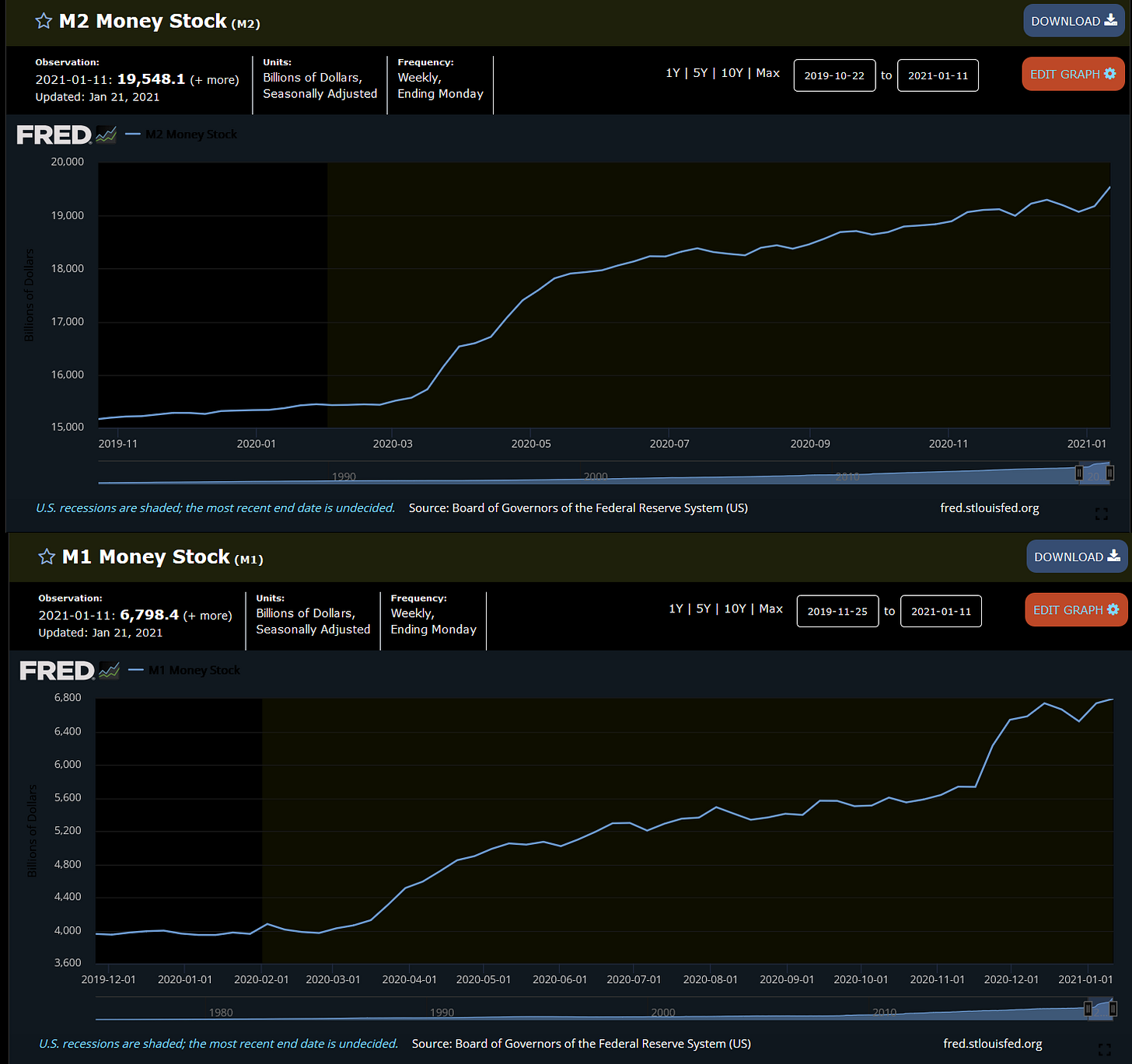

The excess reserves series got discontinued September last year, but the last number lines up exactly with the August 2020 number on this series, so now it's "just" reserves. Which is also worrisome, as it'd mean the QE's excess reserves have finally (quietly) been officially deployed - and it's also a decent explanation of why many prices started going vertical in the 2nd half of last year, including M1 money stock.

Which the Federal Reserve decided to hide to sweep all of this under the rug. Luckily i still have a screenshot of January this year, not too long before they retroactively to May 2020 decided to change it. It's not hard to see why.

That's the catch-22 of having so many reserves. If you have so many reserves to cushion any blow, why would you take any precautions in lending out money? Especially if that money goes directly into synthetic markets as that's the only place Margin is allowed to flow? And more money going in automatically makes the price go up, no matter the source of that money. Any losses are absorbed by yet-more money flowing in via QE. And again - expectations are generated this'll last forever.

Nor do you have much of a choice if consumers simply aren't picking up the slack by taking out more credit cards or car loans because they've reached the limit of their ability to take on debt. Money's gotta go somewhere. Why leave it in a vault (or on a computer these days) when you can invest it and have it multiply itself for you? Money compounds for banks as much as it does for citizens.

Corporate debt

Since the population is mired in debt, what about corporations? Since they've benefited greatly from reduced tax policies and loop holes over the past few decades, can't they (and the rich) be taxed more to solve the problem?

Unfortunately, thanks to ultra-low interest rate policies and The Federal Reserve going as far as to buy corporate debt directly, corporations have engorged themselves in debt as well. And this debt too is going to have to be paid back at some point. For corporations, this is done through earnings. After all, you issue a bond to lend money, you invest that money into more production, then use that production to increase earnings and pay back the bond.

Unfortunately, that's not what happened.

What these 3 charts show are the (nonfinancial, so focused on production) corporations' Debt, Profits and Share Buybacks.

From the first chart it's clear corporations have completely engorged themselves on debts after the ultra-low rate policies were institution after the 2008 financial crisis. This should come as no surprise as it was a debt-binge all around. However the second chart shows that corporate profits have suffered, as you would expect to see a linear expansion in profits along with a linear expansion in debt.

After all, higher amounts of debt require higher amounts of profits to service/pay back without taking a hit to your margins or bottom line. While the dip in 2008 is expected during a massive financial crisis, the problem develops towards the end of 2015, where profits stagnate their rise upwards and start falling. This while consumer credit continued upwards, so it wasn't because of a lack of spending by the consumer.

Instead, the third chart shows the problem. "Security Repurchase Agreements" are fancy words for "Share Buybacks". Company shares work on the same supply/demand mechanics as everything else: If more money pours into the same amount of shares, it goes up. If at the same time, the numbers of shares is reduced because it's the company itself pouring money into its own shares, then you get a double whammy of extra demand + less supply, which does wonders for a share's price.

If we all used shares in Index funds as payment in grocery stores, we'd been talking about double digit inflation for years and years now.

Unfortunately, if debt continues linearly but profits do not, it tends to create a vicious cycle of needing exponentially more profits the next time around in order to "catch up" to your previous trendline of growth based on that debt. Eventually that causes companies to scale back lending and a recession ensues - nudged along by The Federal Reserve which started to raise interest rates on that massive pile of debt, and the market tanked at the end of 2018. That's the reason you'll hear pundits (including myself) say the market now cannot handle any form of higher interest rates.

This has left many companies in a position where they can no longer service their debt without more cheap debt - the so called zombie companies. Normally, this dead wood is cleared by a minor recession every 4-6 years, so it need not be a problem. But because many zombie companies were bailed out in 2008, then again when rates were lowered in 2018 and henceforth, there's no telling how large the problem really is now. The zombie apocalypse happened, just not in the way we expected it to.

That is to say, we don't actually know how many companies couldn't afford their debt pile if rates were to return to historical averages. While we might come up with an initial number with companies that will fail outright, we have no idea what the second order effects on the supply chain are going to be.

Many middle companies will fail, cutting a producer off from the assembler of the end product, reducing available supply from the assembler's perspective - even if the producer has plenty of product on the shelf. The global freight problems should've made clear by now that supply doesn't really matter if you can't get A to B - from B's (pricing) perspective, A might as well not exist.

As for "the rich", most their wealth is tied up in the synthetic markets, which again run on demand, not supply. There's only two options here: Either the market crashes and wipes out their money that way, or the currency hyperinflates and wipes out their capital that way. Just because they have billions now, doesn't mean those will magically increase during hyperinflation when billions are reduced to the value of hundreds today. Assets losing value will still continue to lose value, regardless of the changes in the value of the currency itself.

Even when all numbers are going up, supply and demand is still in effect. It simply becomes a game of which number goes up faster and which one slower, rather then a game of which number will go up and which will go down.

There seemingly is a 3rd option, Billionaires could sell as much stock and synthetic assets as possible and jump into physical assets to protect themselves. Except that the discrepancy between the real economy and the synthetic one has become so large, they simply can't unless they want to crash the entire system by themselves. Too much money has flowed into synthetic assets for too long.

At current prices and inventory, ALL gold AND silver the Comex claims to have, can be bought for a total of $68,166,212,390.70, or $68,2 billion for short. This is approximately half of Warren Buffett's CASH position.

Not the value of Berkshire Hathaway. Not the value of much larger companies such as Apple. Not the value of billionaires combined. No - simply the cash on hand that Warren has to spend on buying stuff.

He can't buy gold. He'd 10x the price by himself, and destroy America in the process. And that's just 1 billionaire. Jeff Bezos sold around $10,8 billion worth of stock in 2020 alone, more then enough to buy out all silver on the Comex's books. I have no idea where that money went. The amount of digital dollars versus the amount of real physical assets out there is huge.

And alas, to go back to the charts for one last time - the spike in profits after the Covid pandemic isn't something healthy. It isn't profits catching back up to a previous trendline through increased sales of increased production, as i'll definitively show in a chart later on. The line is "too sharp" for a production boom; it takes time to create more facilities within reality.

Instead, it's evidence of hyperinflation starting within the US, as profits increasing without production increasing, which can only mean price increases from selling fewer products for more money. And that can only happen when there's more money available to sell those products for. When that line goes vertical - it means the liquidity available to buy products with has gone vertical, something that only happens during hyperinflation.

Or to put simply; The US is producing at 2017 levels while spending at 2035 levels. That won't end well for corporations, the rich, or anybody - so to count on corporations to bail everyone else out is folly.

Government debt

Usually the first to get mentioned is US government debt as it's such a staggering number, but in this case i wanted to name all the other problems first, as it leads to a vital conclusion going into the next numbers on the list:

Taxpayers are liable for both the numbers above, and the numbers below.

Canceling the government debt would mean all the above debt still needs to be paid back - and vice versa. The problem will remain too big.

There is no way around this. That is the immutable nature of debt, as debt that doesn't have to be paid back is a gift in disguise. Either debt will be paid back, or it'll be defaulted on, with the hybrid of the two being paying it back in worthless currency - to which we'll get later.

Government debt takes the shape of government bonds, in the US known as "Treasuries". It works simple enough: The government issues a bond into the market, people bid on it which establishes the interest rate (or how much money the government needs to pay to lend), it gets sold at auction and the government spends the proceeds. Over time, the tax base of the country brings money back to the state, which the state uses to pay down the loan until the bond is fully paid off. This is not inflationary, as the government extracts the money from the market first - which is deflationary, thus offsetting their spending system wide.

Atleast that's how it's supposed to work in an unmanipulated environment. That is not the case today.

For this, you have to understand Location of Capital. It's easy enough, it means that my money is my money and only i can spend it. I cannot spend your money, and you cannot spend my money. Ergo, you do not have access to my money.

Now, Circulation is a funny thing. When we speak of "money in circulation", that means "money available for trade at any given time". Since we can't measure people's thoughts, we measure where people generally hold their money that they're liable to spend at any given time: Checking accounts. At the same time, people put money in savings accounts specifically not to spend it now, but at a later date. So, we consider that money "not in circulation". That's basically the difference between M1 and M2 money stock measures; money that is readily available, and money that isn't, yet is still money.

While it's not tracked, you can say the same thing for assets, especially those as liquid as US treasuries. Meaning, there's a market for these bonds where people buy and sell them for cash all the time, and their price is derived from the price action in this market. Outside of creditworthiness, supply and demand handles the price. More bonds, lower price, less bonds, higher price.

Yields and prices move in opposite directions, so lower prices, higher yields - which incase of government bonds means, if the government has to issue a new bond, they have to do so at the current yield of that bond. So if the US 10 year is trading at 1%, and the US issues a new 10 year treasury, they will have to pay 1% interest - or there abouts depending on demand at the time of auction.

Since supply and demand aren't that hard to understand, it's easy to understand that, if there are more bonds available then demand for those bonds, the price of the bonds would crater much like any other asset. This also means that, if the supply of US bonds exceeds the demand for US bonds, the prices crater, and yields spike. For governments though, this means that their ability to lend is completely restricted: They'll have to issue new bonds at sky-high interest rates, something often not feasible as it has to be justified for by increases in tax income. This also keeps the government's ability to borrow in check and is a natural brake on credit expansion.

ALL OF THIS IS COMPLETELY NORMAL!

I wanted to make sure that's understood, because anybody who's younger then 13 has never lived in an unmanipulated world as far as government bonds are concerned, because of QE. Just because it functions different from history now, doesn't mean that's normal, or sustainable. If we include interest rate shenanigans, we can easily bump that number up to 25 years of age - with the invisible hand of the Fed pushing it up another 10 years since the 1987 stock market crash introducing "The Fed Put".

Infact, i went down that rabbit hole, and i can track the Federal Reserve's incompetency all the way back to the 1920 "forgotten" depression in the US, which the Federal Reserve "solved" by - wait for it - severely reducing lending restrictions banks had on stocks and making it far easier for regular people to invest in the stock market on margin. We all know how that ended.

In any case. If the normal mechanics mentioned above are supposed to happen, but haven't happened yet, there must be a reason for it, right? Indeed there is, and that's why i started this section with location of capital.

If there was some place where you could "hide" treasuries, meaning keeping them out of circulation entirely, you could fool the market into thinking demand is higher and supply is lower then it in actuality is. After all, all the market sees are bid and ask orders. It can't read minds. It can't know that you're sitting on a pile of treasuries with the intent to never ever EVER sell them.

....

Sound like anybody you know?

Ysee, when you can literally print new money - you have no need to sell. And demand/supply mechanics run on desires (as i describe in my books). Somebody desires to have an asset, and somebody else desires to trade that same asset for another asset.

But if you have an entity with no need to trade, yet can continue to buy - that skews the specific market that entity is active in. In this case, the Treasuries AND Mortgage Backed Security markets. So yes, while i didn't mention it earlier, the US has a housing bubble too, and it's being propped up by the Federal Reserve this time around, rather then "big banks" buying mortgages sight unseen.

If you're buying $40 BILLION worth of houses A MONTH - there's no way in hell you have ANY idea what you're buying, where it's located, or if it even still exists. That'd be true for pure mortgages - i'm not aware of the Fed possessing an army of housing inspectors to validate these bonds - so you can bet your ass these packages of arcane securitized slices go completely unchecked. The Federal Reserve has never been audited to my knowledge, nor will they ever let anybody take a look at that Schrodinger's balance sheet.

As long as nobody looks inside the box, it's both valuable and full of shit.

In any case. Whether or not the United States is bankrupt through having reached the limit of demand for government bonds can be answered by another question:

"If the Federal Reserve offers their balance sheet up for sale in the markets, would the markets absorb that amount of government debt; or would the markets crater due to demand becoming overwhelmed and supply mattering again all of a sudden?"

I think we all know the answer is a resounding no, it can't. The nominal number is just too big. The US would go bankrupt overnight. Which is exactly the reason why the Fed is hiding all those bonds on their balance sheet.

That they're getting away with it doesn't mean the US hasn't gone bankrupt.

It means the rest of the world is still stupid enough to sell them a hamburger today to get paid back on Tuesday. Until it's run out of hamburgers. And one day soon that'll end.

Real soon.

....

Oh shit i forgot to add the mandatory numbers of the apocalypse.

Currency Debt

Here we come to the crux of the problem. Something that is inherent to the Fractional Reserve system, which is the currency system employed currently by all governments in the world.

What Fractional Reserve means is what the words imply: Someone has an asset as the basis for money - the collective amount you have being called "the reserves" - and a currency unit that represents that reserve, while the amount of the currency unit in circulation exceeds the total amount of reserves by a certain, often significant amount.

It's easiest to think of a fractional reserve system combined with a gold standard: You have paper money, which is "backed" by gold reserves, to the tune of a certain number of currency units per unit of gold, usually measured in "X per troy ounce of gold". For example, for a time the dollar was considered worth $35.31 dollars per ounce, while that peg broke when the gold/dollar reserve ratio dropped below 8%. Meaning, for every ounce of gold, $441.38 dollars were actually in circulation, and if more the 8% of those holders redeemed at the same time - the US would have to default on its obligations, namely they can't deliver gold they don't have. So in 1971, the US left the gold standard for a transitory period that continues to this day.

Since that event the world's run on pure fiat, but that doesn't mean that fiat isn't fractionally reserved. The way money is created in our system - outside of the central bank - is by commercial banks lending out money to corporations and citizens. These banks are allowed to leverage up a principal amount, turning $100 into $1000 of "phantom money" which is lent out to businesses. When the money is returned, it is levered back down (destroyed) to its principal until a new loan is made with it. Except the interest rate, which is profit for the bank and becomes the bank's principal.

Location of capital here makes it work: Even though there's no discernible difference between the dollar principal and the levered up dollars, banks can't lend themselves (or each other) $100 in order to lever that up to $1000. So while both the principal and the "phantom" money are fungible and worth an equal amount, only the principal is "real" money.

This is what i mean when i say "debt is money". Both the commercial banks and the central banks have to issue loans in order to print money. This is true now, but this is also true when you shrink the monetary base to almost nothing. It is the system we live in. For the central bank, the government lends the money from them into existence, with a promise to pay it back, and the interest being profits for the central bank. Indeed - The Federal Reserve "remits" alot of its yearly profits back to the treasury.

Because everybody knows the system is bullshit and it's just one hand paying the other. Still. That statutory 6% dividend the Federal Reserve pays to its private bank shareholders must be pretty sweet right about now with 5,4% on the CPI. Just can't figure out their motives for pumping up the money supply though.

In any case; as far as "the problem is too big" goes, this is the real key to the story. If it was really just a case of "too much debt", businesses and banks could still fail like the old days, we'd suffer a depression, but we'd come out the other end with another economic boom. Some people lose, some people win, and the world moves on.

But it's not. Debt IS money. We live in a fractional reserve system where the value of the debt underpins the value of the currency.

The idea that the US dollar is Fiat currency is wrong and will lead to massive suffering, already showing its face in markets today.

Under a gold standard, the value of the gold underpins the system. People look at the gold standard with rose-tinted glasses, because the government/federal reserve pretty much continually printed money under the gold standard, continually inflating the value of gold. You pay more dollars per ounce because the value of the dollar was lost compared to the value of gold, which holds its value because it doesn't rust or go bad. Gold is immutable.

But what if we'd ever met a situation where the government wasn't printing money, and we suddenly found a giant gold mine that massively inflated supply?

The value of the currency would collapse, even if not a single dollar was printed. ALL prices would go up in unison, because the thing pricing those assets - gold - lost value.

It's not a case of "if no dollars are printed, the price of the dollar stays the same while the price of gold drops." It's the value of the asset that underpins the value of the currency. Not the other way around.

What would happen, is that because the value of the currency drops, you go straight into a liquidity crisis as prices skyrocket but no new sources of liquidity are created. The government would be forced to print paper, as if they don't - prices still skyrocket, only now, nobody can pay any money for them as the increased prices reduce the locations of capital (and liquidity with it), so a depression ensues.

Now imagine the system having a Debt standard (or a Credit standard if you will) instead of gold, and finding an $8,5 TRILLION dollar "giant gold mine" filled with Debt. Same thing would happen. Hence why all that debt is locked up on the Fed's balance sheet never to see the market again.

With the difference being that, gold isn't a loan by itself. Gold doesn't have to be paid back. Debt does.

Debt both is money, and is backing money - but debt itself is not the currency token representing money itself; that's the national currency. They're two separate things sharing equal value, just like paper money backed by gold under a gold standard.

You can buy a bond with currency, but you can't buy groceries with a bond. So while the bonds are multiple things, they aren't legal tender. They are money, because no dollar is made without debt - they back the currency, as the value of the bonds determine the value of the currency - but they aren't currency themselves, as you cannot use them as a liquid means of payment, just a liquid means of acquiring currency - atleast, for most bonds.

So:

- To pay back debt, you need currency.

- To create currency, you need debt.

- Debt has interest rates.

- More currency needs to be paid back then is created.

- Ergo; there is always more debt then there is currency. Debt = Currency + Interest.

It doesn't matter how long it takes for the system to completely fail, the system itself is finite. Because debt needs to be paid back, it depresses future income and there's always more debt then currency; there MUST come a point where the system collapses in a cascade of defaults where literally all money goes poof at the same time - and then some.

This recursive loop also predicts what the end point will be: Hyperinflation. Simply because it's an unacceptable conclusion for literally everybody and anybody in charge that the only solution is the entire system evaporating. Total destruction is not often thought of as a solution.

The only real option anyone in charge has is to literally run the system into the ground by just continuing the loop into infinity. Gold has long since proved even it is not immune to supply and demand mechanics: When the Spanish conquered the Aztecs and brought home their abundance of gold, so much gold was added to the Spanish economy that the price of gold itself cratered, and all prices went up throughout the entire economy - and the country essentially became poor overnight by wiping out relative wealth.

The same can happen with debt. If one just produces so goddamn much of it that nobody wants any of it - it will have NO value. Demand always comes before supply. A rare artifact which literally nobody wants, has a price of zero. Nobody will buy it off you, so nobody will set a price, no matter what you yourself think of what it's worth.

This doesn't mean the debt will be paid back. That's mathematically impossible. The system is set up to not-allow that. Hyperinflation just means hyper-creation of debt when money is debt. You can't solve more debt with an extreme amount of more debt, either. It just means that, by the time the government is willing to default on that debt, all bond holders are ground into such a bloody paste that literally no one is going to care whether it's allowed by the constitution or not. There simply won't be a choice, and not enough people left to care.

You might call that evil. I call it inevitable. Were i in charge, i wouldn't be able to do anything differently. If somebody starts a revolution, that's where they'll end up anyway after a bloody conflict; still defaulting. This is simply the result of implementing a bad system 107 years ago, and then papering over mistake after mistake to keep it going. The people who caused it originally have long since died, there's no one to blame except the current incarnation of idiots, which are never on their life going to stand infront of the cameras and pronounce the jig is up.

In any case, this is the situation we find ourselves in today. There is too much debt, and not enough money, with the only way to obtain more money is to create more debt.

And thus, we roll from a liquidity crisis, where a shortage of currency due to credit implosions forces us to print money, into a solvency crisis, where printing money leads to an increase in debt while there's already too much debt and not enough income, causing credit implosions.

And as exponentially more debt and money is added to the economy, its value drops, dropping the value of the currency itself, causing prices to skyrocket across the economy.

And; since we're talking the US here, and the US has the global reserve currency, "the economy" means "the dollar economy", which means the entire freaking planet.

Which is why the supply shortages are global, and not localized to the US. In other countries, products produced locally aren't suffering that much, provided that country isn't printing itself into oblivion as fast as the US is. There's for example little reports of food shortages in food producing nations, while imports around the entire world are affected.

I hear you asking; but why are goods running out? Shouldn't it be the case that goods priced in dollars simply go up in cost tremendously, causing the US to cut back on imports, leaving more for the rest of the world and keeping those prices normal?

Well - aside from ALL major governments on the planet printing their ass off keeping the dollar more or less at parity against them - the reason why everybody seems to be suffering from rising prices at the same time while countries have printed money at vastly different rates, still is because of the dollar - and for that we have to talk about a last form of debt and a problem that has gotten too big.

Production Debt

So far i've mostly talked fiat currencies and money. But it's not the only form of debt out there, just the debt that is fungible with eachother and can wipe eachother out (any dollar can pay down any dollar debt). Production debt is production you've promised to deliver, but have not yet produced.

Most of this debt flies around in Futures markets. These markets are where contracts trade for delivery on a specific date. You can trade these contracts up to a specific date, until which you have to indicate you either stand for delivery or wish to roll over to next month's contract and continue playing the price game. On the producer's side, they make a contract for delivery at a certain date, and once that date come, they deliver at the price the contract traded at. Big banks offer a buffer of inventory in between delivery dates into which producers can deliver, in order to smooth things over.

Futures are extremely dangerous in this way and will most likely be heavily restricted, if not (hopefully) outlawed in the future once these problems come to a head. Even the Tulip bubble could form because of essentially the world's first futures market. The problem comes from modern futures markets (especially the US one which i know best) where not just producers are active, even when futures were designed as a producer price hedging tool.

Lets take gold for example. Every time a producer makes a gold bar and sells it onto the market on the Comex (The US precious metals futures exchange), they also make a corresponding short contract at the same time - so 1 contract backed by a bar, and 1 without. This means that if the price goes up between the making of the contract and the delivery of the bar, the producer makes more money on the contract with the bar, but loses money on the contract without a bar - which he has to buy back at the same time. Rather then make money on the spread, the producer makes money on the bar being sold, and the spread just exists to stabilize the price of production into something predictable, rather then selling spot whenever the bar is produced.

But bullion banks have this ability to create contracts backed without bars too, so called "naked shorts", and boy oh boy, have they abused that power. With a reason ofcourse, but we'll get to that momentarily.

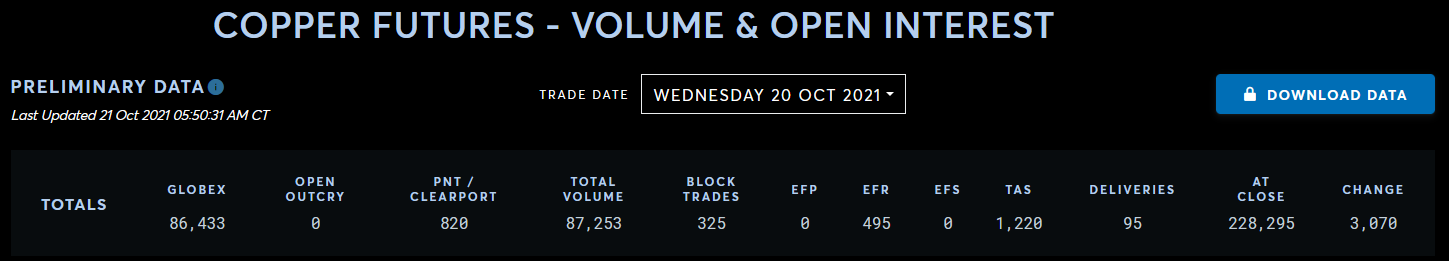

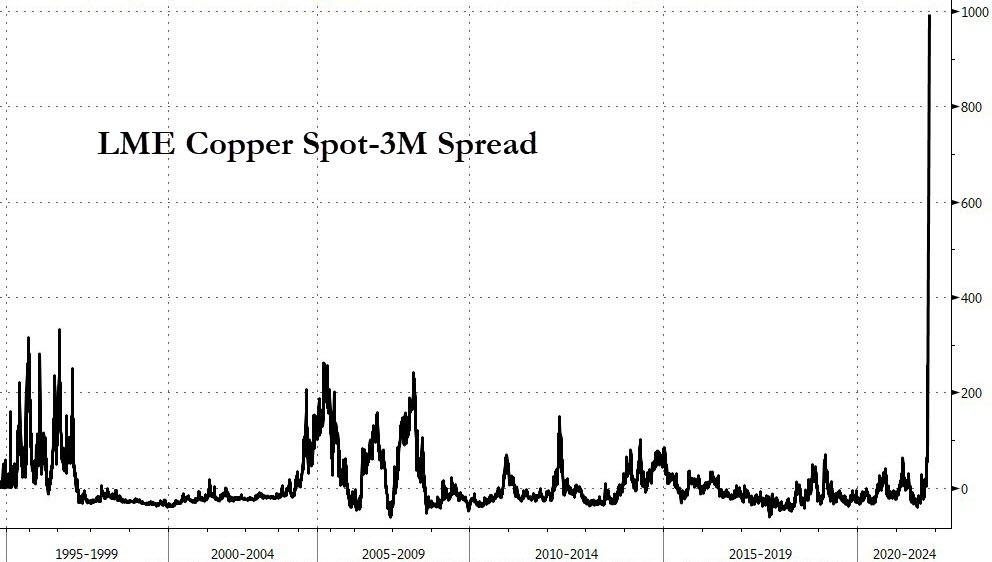

For now, let me first show you how incredibly leveraged the Comex is on an particular asset as an example, and lets take Copper as it's currently under the most stress.

There's 2 parts to the market that i need to explain, Open Interest and Stocks (the physical kind). Total Open interest is the total amount of Futures contracts trading on the market. 500 contracts means an open interest of 500. These contracts have a standardized amount for delivery, in the case of Copper it's 25,000 pounds. So if you hold a contract to delivery, and it's priced at $4, you pay $4x25,000=$100,000 to receive 25,000 pounds of copper. Stocks then are the physical pile of metal this amount is delivered from, while the contract issuer delivers back into this reservoir of metal. This is held in warehouses which have the relevant contracts with the Comex.

So; even without direct math and just guessing. Knowing each contract is worth 25,000 pounds; if i were to tell you there were 228,295 contracts outstanding:

While the Comex says they have 56,092 short tons of material in their warehouses:

You can already feel the problem. It's one thing to not be good with math, but once we're talking orders of magnitude worth of difference, you can intuitively feel something terribly wrong. Lets do the math to see how horrible the situation is.

First, part of the obfuscation is that the Comex lists inventory in Short Tons, while contracts are in Pounds. 1 short ton = 2000 pounds. So, 56,092 short tons = 112,184,000 pounds of copper.

1 contract = 25,000 pounds. So, 228,295 contracts x 25,000 pounds per contract =

5,707,375,000 pounds of copper. Or, /2000 = 2,853,687.5 short tons.

Alternatively, 56,092 short tons = 4,487.36 contracts.

Or best put, since we've already talked about fractional reserve systems:

The Comex has fractionally reserved Physical copper to Paper copper to the tune of 228k/4,5k = 1,97%.

Meaning, if every single copper contract out there stood for delivery at the same time - much like every person withdrawing their money from the bank at the same time - EVERY contract holder would need to take a 98% haircut.

For every 25,000 pounds of copper traded - 491.4 pounds of copper exist in the warehouses. And eventually, that party has got to end.

This is what happened when the Comex's brother - the London Metal Exchange - ran out of physical copper in its inventory, during global copper shortages. They've since "tamped down" on this and depressed the price back down, but in the end commodities are different from all other assets traded that run short on supply:

When supply is gone, new supply has to be bought at whatever price. There are no circuit breakers on commodities, because there are none on reality. The ground won't supply copper faster unless we build mines, and that takes time and money whatever we believe. And if your need for copper is immediate - as for example you've got a bunch of shorts outstanding which mean that, whenever you close them, you have to buy physical supply in the market at whatever price it is then....

Well there is no answer to that. An unmovable object facing an unstoppable force. The price could technically go to infinity. It won't stop until the people who can't close the shorts, declare bankruptcy, and those expecting metal simply will never receive it. There really is no other answer. Somebody is simply not going to get what they need.

Which in the case of the Comex is a bunch of very big globally systemic important banks:

That chart also tells you which commodities will soar the most when that problem comes to a head. And it's also here that we come to the part that ties this together with the rest of the article on money and debt:

The 3 highest shorted commodities, by far, are Gold, Platinum and Silver. All 3 precious metals, and in the case of Gold and Silver (and Platinum in a minor way too), these are money.

Or better put, former standards of money. Gold and Silver having been money for thousands of years, and as such, are often still thought of as money - what is called sound money, where the value of the money is contained within the asset itself. Gold is gold, and that is what gives a gold coin its value, not the promise of the denomination ontop of it (same goes for platinum by the way for the idiots out there who still need to hear it).

When a short is sold into the market, it effectively increases the total supply by 1. After all, there used to be say 100 contracts, now there are 101 in the market. Shorts are still backed by material, you have to lend the asset off somebody first to sell into the market, and only the risk of extreme prices to buy it back and that person defaulting on that obligation are a risk (which is why the short seller pays an interest fee to the owner of the asset). The material itself will still be floating out there and can be bought as raw resource input for a machine (at a price). As stated before, producers always sell both long and short at the same time, and this is by design.

But naked shorts, since they have no underlying material available or even planned for, have no such limitation. They can continue to be sold into the market ad infinitum.

Naturally there has to be a limit for how long that can go on, all good things must come to an end. And there is, it's the same as banks with bank runs: Even though the contracts are sold into the market without backing, they're as good as contracts with legitimate backing. There is no way to distinguish a normal short, a naked short or a backed contracts from eachother until the moment of delivery.

So, if the market grows due to more participants trading, and enough participants stand for delivery at the same time to push the reserves past empty for whatever reason - everybody else still holding the contract will be cash-settled out. Meaning, while you thought you where holding copper, you're gonna get money - with no ability to find copper anywhere else, because the price skyrocketed virtually instantly, and now everybody's hoarding it expecting price to go up further. The horrible ramifications should be obvious from this point onwards, as no raw material = no production of anything containing copper.

But we aren't there yet. So currently, we are still in a situation where the amount of paper silver and gold vastly outnumbers the actual physical silver and gold. But, since it's contracts available for delivery - this paper gold is counted to be as good as physical gold.

Which'll hold true until the very day that delivery limit is reached and suddenly, everybody holding paper misses out on the trade of a century.

So, we have a situation where people think the amount of physical gold is vastly higher then it is in actuality. Naturally, since people think supply is vast, they will value the asset less, whatever it is. This holds true even for gold. So, when people see a price of $1800 for gold, they're OK with that.

If you'd offer those same people a legit gold coin for $180, they'll ALL take that deal immediately. Why not? Instant 10 times profit. Yet, that's effectively the situation we're in right now. The price should be 10 times higher based on physical supply - but it's 10 times lower then it should be because people think there's 10 times as much supply then there really is. If people knew the truth they'd have rushed gold and silver long ago.

But - this then is also the crux of why the Comex continues to suppress precious metals so heavily. Because precious metals are seen as money, should gold and silver explode in price, that must mean the Dollar dropped in price. Since gold/dollars is effectively a currency pair.

If the Euro would go up 10x overnight vs the Dollar, you'd say the Dollar lost 10 times its value VS the Euro. With Gold it's no different, the Dollar would lose 10 times its value VS Gold.

So, because we're currently in a situation where the Dollar as measured vs Gold is grossly overpriced. And since everybody looks at the Dollar price of Gold as a yard stick to measure the value of the Dollar - it is grossly overvalued world wide.

Which then also explains why the global shortages keep happening in imports. Because the Dollar is used for half of all global trade, half of all products world wide are being sold for less than they're worth. People should ask more dollars for their products, because all their products are ipso facto also measured against gold.

Raw resource inputs means resources are being underpriced in dollars, and thus they are less profitable then they should be. Refined products too, shipping too - everything in the goddamn chain. And this is why the supply problems persist and new supply isn't coming online fast enough. The companies aren't making enough money to invest in CapEx spending, or why they can't raise prices faster then inflation - they're mass under-pricing their products because inflation is running far hotter then anybody thinks!

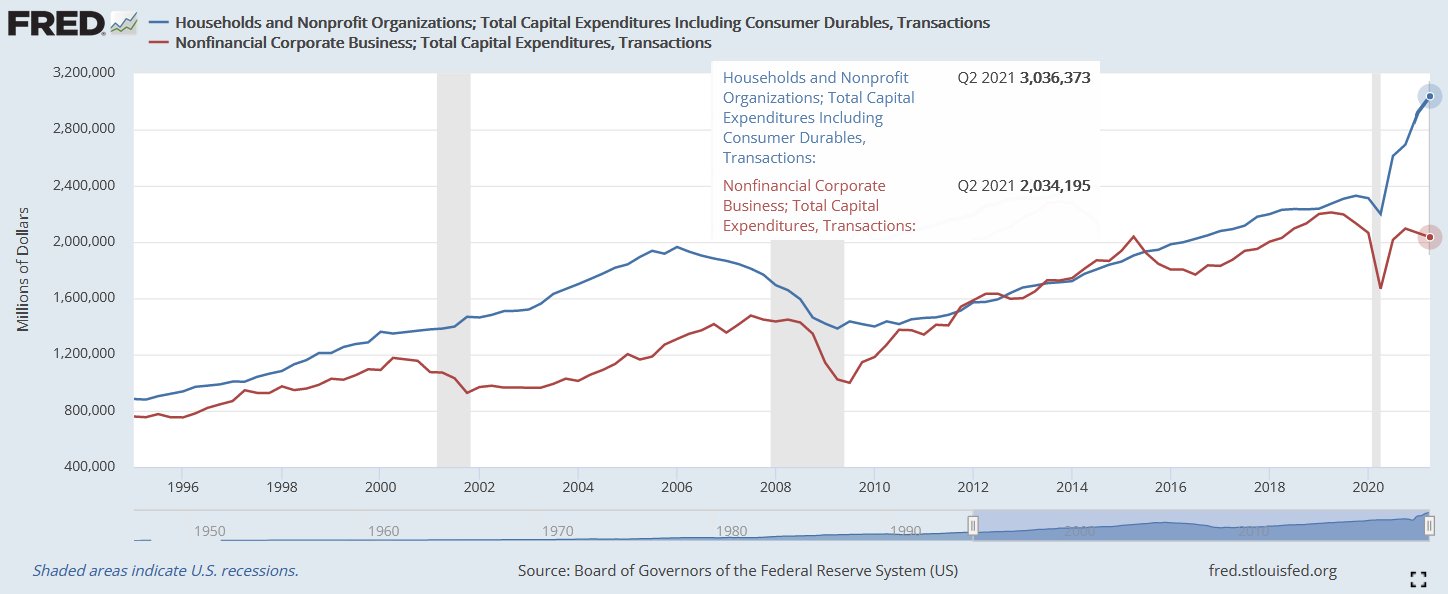

This chart shows that effect in reality. Consumer spending is going up, because money is plentiful. Even if they can't take on more debt, stimulus checks and unemployment handouts still allow more spending beyond being broke. The chart shows the same effect in the US housing bubble of 2002-2008, as it's clear consumer spending wasn't being fueled by production, but rather expansion of debt somewhere in the economy.

Meanwhile, corporations can't raise their prices fast enough to compensate for this new money. As a result, their margins are being crushed and they cannot invest in capital expenditures in order to get more supply online. Their income is going up, but their cost of revenue increases equally rapidly. This then becomes a self-reinforcing loop, where more money chasing fewer goods crushes margins more and more until businesses either engage in drastic price raises (and then no longer sell anything because then the pendulum swings to people needing more money yet again), or they simply.... bleed to death.

The above chart is the best chart i can give you to show the "transitory" narrative behind inflation is utter horseshit, and will come back to haunt the west in a major way. More time squandered that could be used preparing for the end, or atleast trying to make the landing not so hard.

Production CapEx just isn't being spent! This necessarily, logically, MUST mean no additional production CAN come online!

And a downtrend since 2019 means the US has 3 years of production to catch up to, in addition to creating all the necessary production to justify the expansion of the money supply since 2019!

If prices were higher still across the chain, producers could make the necessary money for investment. But because the US consumer has reached the utmost limit of how much they can spend on credit, they simply cannot afford higher prices without higher wages, fueling the internal inflation cycle.

And all of this is measured against the gold price, because if people expect inflation, they look at the gold price to check if it's happening, and it is not moving up. Instead, gold remains suppressed in price because of a large supply of paper considered to be as good as gold. This allows the dollar to be valued more then it's worth, and as a consequence, the US exports inflation to every nation using the dollar on the planet - which is all of them, as the dollar is the global reserve currency.

It is the only theory out there that explains why the supply shortages are global. It explains why every country is experiencing inflation, even a country such as Russia which - on paper atleast - looks like a dream to invest in. A heavy commodity exporter at the start of multiple commodity squeezes, with virtually no governmental debt compared to everyone else, mostly no indebted population (just poor, so credit risk prevents credit expansion), demographically stable, growing in importance geopolitically, money supply mostly backed by gold, and has even hiked interest rates multiple times now!

Russia's 10 year went from 4% to 7% over several successful hikes, and nothing happened. Because the Russian economy can easily handle this. It's mostly seen as a commodity exporter with its currency tied to Oil and Gas. Well, Oil's 20% higher then pre-pandemic while Gas has gone through the roof and quadrupled. Meanwhile, the Euro is still 1:82.9 Rubles at the time of writing, while pre-pandemic, that was 1:68 and falling.

Russia's got a national wealth fund filled with cash and gold for crying out loud. It's 7% of GDP - meaning if the US had the same, that'd be a fund with ~$1,6 TRILLION IN CASH AND GOLD. And now even without dollars, because financially speaking Russia's the only country making any sort of sensible decisions right now and they're de-dollarizing at a rapid pace.

How the hell are they having inflation, and why is the Ruble valued so poorly? I'd prefer the Ruble over any other currency right now.

Well, because the goods they buy are priced in dollars. Not all, and they're doing the best they can to de-dollarize precisely because of this fact. But fact of the matter is, most trade still happens in dollars, the dollar isn't losing its value (it's not that they don't know about futures shenanigans, but nobody would believe them anyway), and Russia still imports alot of finished products; so the Russian central bank has to offer more and more interest to savers to keep them in the game.

But for the Russians, it's simply heavy inflation. They can afford to give the savers more money, and as the numbers are going up in unison, it's not so much of a problem. Bread costs more, but you have more.

The US on the other hand wouldn't even survive an official hike to 4%, let alone 7% on their 10 year. Savers have been annihilated with a decade-plus of artificially low rates, meaning any sort of expansion has to come from an expansion in credit, as there's simply no savings available to invest with. Banks would start getting income off interest again, but since nobody can pay higher interest rates, it'll make lending down right impossible. Revolving credit freezes up, and the solvency crisis swings back to a liquidity crisis - swinging more and more violently with every swing back and forth.

I'd calculate the fractional reserve backing for gold right now so we might find out exactly how deep the problem goes, but unfortunately the gold market is so opaque and rife with shenanigans, that literally nobody knows.

Nobody knows how much gold has been lent and re-hypothecated (meaning promised to multiple people), and with that, how many people will lose out on how much when the first delivery failure happens. Whether it's 1 bar or 10,000, a delivery failure is a delivery failure and will surely herald the end, sending shockwaves and panic through the commodity markets.

Even if we can track the Comex, the LBMA (London Bullion Market Association) which is the historical center of gold trading, is even more opaque and even more sketchy. This is one crisis that's impossible to predict in breath until it finally happens.

But until it does - global supply shortages will continue to happen, as the asset that is pricing all these products - the Dollar - has artificial value it's not supposed to have.

By hiding the true supply of physical gold and silver via Comex Futures, while at the same time hiding the true supply of the asset backing the Dollar - US government Debt - by stuffing the Fed's balance sheet with it and keeping it out of the market;

The world's successfully become convinced the Dollar still has value, while it most assuredly does not.

To the point that people will freeze themselves to death over it coming winter. And the next, if we continue to ignore this problem.

Either the Americans lose it all, or everybody else does. There's no other way.

Incase you're wondering whether they deserve it or not, just think of it this way: 75% of all Platinum is found in South Africa. Meaning, Platinum exports are a large part of their economy.

Since Platinum is as shorted as Silver and Gold on the Comex, the real price of platinum should be much higher, maybe even multiples from here. The price of Platinum rising won't affect global currencies that much, as it's not seen as money primarily. Its retail investor base is tiny.

But it would mean that South Africa could sell their Platinum ore for many multiples. This would cause the country to become richer almost instantly, and even develop on their own terms, rather then at the behest of yet another colonial power. Their asset, their money, their choices.

South Africa has a population of 60 million. That entire population is kept poorer and more underdeveloped then if they could trade their resources in a fair global market place.

And it's happening to the benefit of the 8 largest traders on the Comex.

Gold and Silver i can sort of understand. That holds the fate of 340 million Americans and even the world. National security and all that, ofcourse they'll fix it to their own benefit, everybody tries to.

But Platinum? The market didn't collapse when the Palladium shorts finally blew out and Palladium tripled. I doubt most people even know that happened.

As Mark Baum said in The Big Short: "You can afford to make less, make less."

I wish i could offer a solution, but i'm afraid all of this is nothing more then past foolishness catching up to us. There's nothing that can be done now; the world is simply afloat in promises that need to be made good. The rest of the world is in the same boat as the US, as all major currencies are valued against the global reserve currency, which is the dollar, rather then against gold directly. Once The Great Revaluing happens, where we check how much actual gold there is VS how much actual money there is, all other major currencies will also drop to whatever level they're actually worth.

As long as debt is money, and there is too much debt, there is too much money. As long as we keep producing debt faster then products, inflation will continue, because the debt will continually be more numerous, and thus less valuable, then the products. I've thought about this in more ways than i can count, and every single time - i come back to the devaluing of the asset behind the currency as being "the" problem. And as long as it continues, every derivative problem continues as well.

Buy gold and silver before they squeeze and hang on for dear life so you don't get left out and starve. Not to make money or get rich, but not to lose it all when the time of collapse comes. As far as i'm concerned it should've happened already.

Oh, and buy my 3rd eBook; Ethereal Value and the Cryptofuture! While it may be too late for us and our generation, atleast i've managed to develop a system for the next generation which offers some protection from the fallacy of having credit as backing for money, while offering a superior value as a backing, for a true Virtual alternative to Fiat AND Physical global reserve currencies: Mathematical Research.

Because the only possible way out that i've found, is innovation. By creating value at a pace so fast by opening entirely new markets and economies, we end up justifying a large amount of the monetary base with value anyway. We may not be able to escape past foolishness, it may yet still be possible to innovate ourselves into a soft landing. But we'd better fucking hurry...

- Kirian "Deso" van Hest.

Find me on Twitter! https://twitter.com/DesoGames

Twitch: https://www.twitch.tv/desogames

My own website: https://www.desogames.com/

And buy my Ebooks for alot more content like this!

The Definition of Money: http://books2read.com/u/bzdaVz

The Definitions of Value: http://books2read.com/u/3yaZWv

Ethereal Value and the Cryptofuture: http://books2read.com/u/bMwrNA

Thank you for this detailed breakup. The different kinds of debt are (intentionally) convoluted and interrelated, and I hadn't seen the scale of the problem, even though like most casual watchers of money, I had noticed the nature of it.

Obviously between the layers of complexity and the finger on the scale, it's hard to predict, but what magnitude of a debt default do you think would trigger the next 'crisis'? Would companies like Evergrande qualify?

Also, at a personal level, if you have a line of credit available at fixed rates, doesn't it make sense to take it on, since hyperinflation would allow you to pay it back less 'purchasing power' than you borrowed?

>How are you going to pay down a mortgage with the house itself after it's risen in value?

I don't follow this.

If the house gains value, you'll simply have more equity. The loan won't change.